It is very important know what type of trading strategy will fit your mental and psychological self? Who are you? Do you know yourself?

Is it harder for you to stay in a trade for longer than one or two legs? Or do you enjoy letting your trades run until they stop moving in that direction?

Chances are that very few of us will be willing to stay in trades for longer than it is absolutely necessary.

There are two approaches to trading:

- Swing Trading Strategy

- Trend Following Strategy

Swing Trading: Swing Trading is a strategy that focuses on taking smaller gains in short term trends and cutting losses quicker. The gains might be smaller, but done consistently over time they can compound into excellent annual returns. Swing Trading positions are usually held a few days to a couple of weeks, but can be held longer.

Trend Trading: Trend Trading involves looking for bigger trends and holding positions as long as possible. One such way would be to using some king of trailing stop loss mechanism that allows moving Stop Loss to a better location. This means locking profits as price goes in your favour while still staying in the trend as long as possible.

Some people make the mistake of simply referring to chart time frame and deciding if its Day Trading, Swing Trading or Trend Trading. The reality is that time frame does not decide if you’re trend trading or swing trading. You can swing trade on any time frame. Likewise you can trend trade on a one minute chart or a weekly chart. And just like that, you can be a scalper scalping the daily chart. More on this in some other article. But for now, lets focus on the topic.

One of the difference between Swing and Trend TRading is the Win rate and Risk to Reward Ratio. Beginners would often confuse the two and make crucial mistakes. If you implement a trend trading method and expect to have target take profit levels and quick exits then you’re mistaken.

If your trading strategy is a swing trading system but you want to catch big huge winners, you are mistake and you will frustrated.

These are the difference between Swing and Trend Trading

If you Swing Trade you should be looking for 2 to 3 times as much as you risk based on chart formations.

If you are trend trading you should not have a take profit level. You should use trailing stop mechanism in order to catch big winners.

| Swing Trading | Trend Trading |

|---|---|

| Risk to Reward Ratio of 1:1 to 1:2 or 1:3 | Risk to Reward Ratio of 1:3 to 1:10 or more |

| Higher Win Rate of 50% or more | Win Rate is Lower between 15% to 30% |

Most traders don’t understand the above. It is VERY important to understand that you have to keep win rate high if using swing trading methods. For scalpers or Day Trading scalpers, the win rate is over 60% or else they won’t success because their risk to reward ratio is often 1 unit or less.

For swing trading it is a must to keep your win rate between 40% to 60%. In order to do that, you have to filter the iffy setups. Your method must include filters that eliminate lower probability setups. Entry timing is very important for these methods.

If looking for “trend trading” type of trade management, then your entries can be as many as you like, entry timing is not very important, it all then depends on managing your trades. This strategy does not need Clever Entry Timing it needs clever trade management.

We here at iTradeAIMS apply swing trading method to forex on the hourly charts. But it’s a hybrid of scalping and swing trading. Which is why we need to keep win rate above 50%. We do Precision 2R scalps while swing trading. Which means, we want to make sure our entries are crème de la crème.

and that means, only trade a small portion, one LEG/WIN/WAVE, within an “established” and “confirmed” trend.

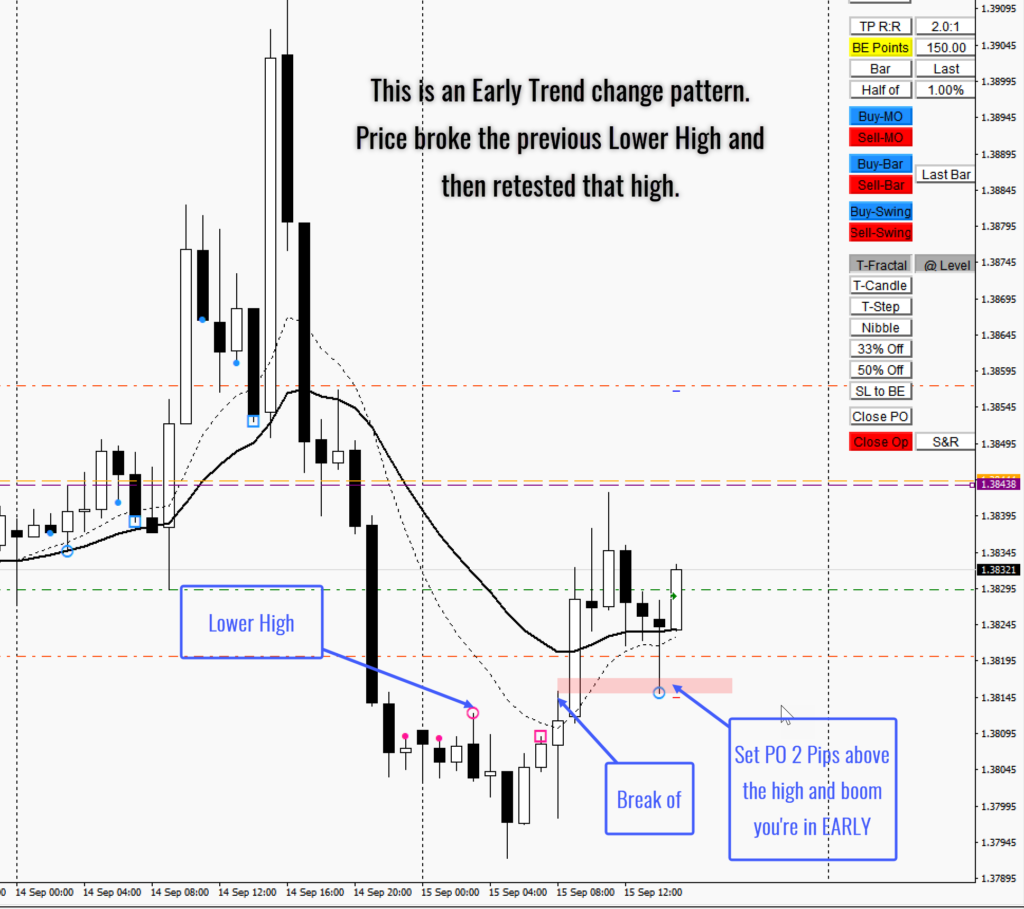

What is the difference between “established” trend and just a “trend”? There are times when markets turn around and begin to move in a new direction. At those times, the trend is NOT yet confirmed. It is potentially going to be a t rend, but not confirmed.

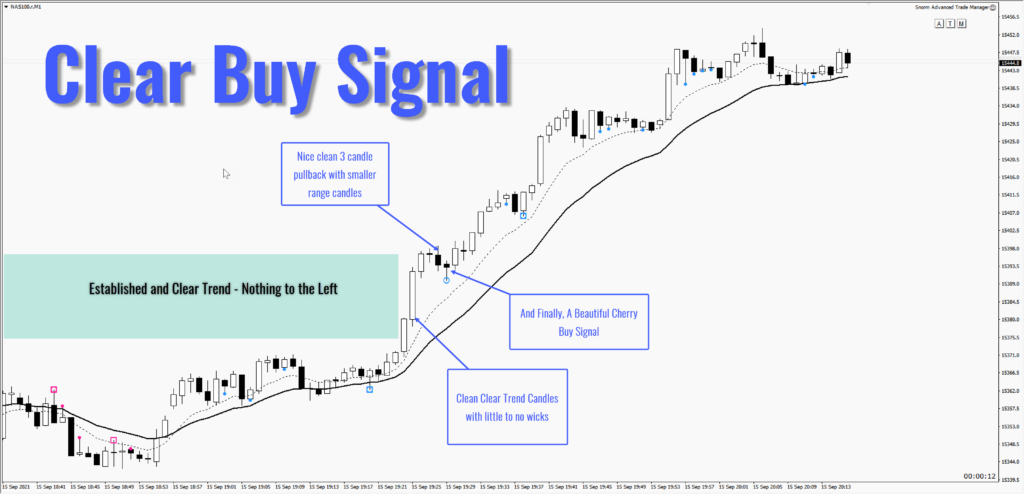

The chart below shows a confirmed and established trend.

We ONLY take AIMS The Hunt 2.0 Signals within a CLEAR Wave 3, or CLEAR WAVE 5

or in other words we make sure to ask the following questions before we trade:

Before taking a Long HUNT 2.0 Entry Signal as these questions:

- Is there a New Higher High (If Bullish Signal) or a New Lower Low )if Bearish Signal) ? If yes,

- Then look for a good pullback (What is a correct pullback?)

- Then look for Confirmation Candle with Hunt Signal.

And that is how you keep your win rate above 50% and extract only the BEST crème de la crème entries.