Always Take Trading Decision Based on Market Generated Information - ONLY

Traders are often told to exit at 2R but is it really a sound advice? What is the Correct Way to Take Profits? When should you exit a profitable trade? What is the best way to do this?

Remember this Very Important Point – Often traders don’t get it.

Before we go into this important point you should know a bit about the 3 Stages.

When you join the iTradeAIMS community we put great emphasis that the secret of trading success isn’t in great technical analysis. The secret of successful trading is the mind. And when we say the mind, all we mean is the ability of a trader to remain disciplined. So, we give you The T20 Principle. We ask you to Accept the Discipline Challenge.

The lucky ones who have the fortitude and will to accept the challenge embark on a journey of self-improvement and self-discovery. They would start at stage 1 of the training process. This is a step you must take whether you’re an experienced trader or beginner. Everyone must go through these first two stages, at the very least.

Stages 1 and 2 are there so that you can find out what kind of trader you are. You will find out how disciplined or the opposite of disciplined trader, you are. You will find out quickly what are your main trading problems.

So, these notes are not directly applicable to you if you’re going through stage 1 or 2.

Cardinal Rule: Always Take Twice As Big Winners as Your Losers

We always talk about at least 1:2 or 1:1.5 Risk to Reward Ratio on average. This seems to be the standard advice in this industry. And it is not wrong. It is the very best of advice when it comes to risk and trade management.

But we fail to understand that it is a model. You want your overall results, to be somewhere near those figures. But that does not mean that every trade will be exactly 1R Loss and 2R Profit.

You can’t be perfect about it but that’s the baseline we want to achieve after say a series of 500 trades or something.

The point here I want to make is that when you’re trading; when you put that trade, and even if you have a Hard 2R target point you must accept what the market is telling you at any given point.

While in stage 1, I told you to let your trade run, no matter what happens, whether it goes to -1R or 2R, it’s out of your control. It is the goal of stage 1 that you trade in that mechanical fashion.

But that is just for stages 1 and 2… The real transition occurs when you enter stage 3.

Let the Winners Run and Cut the Losers Short

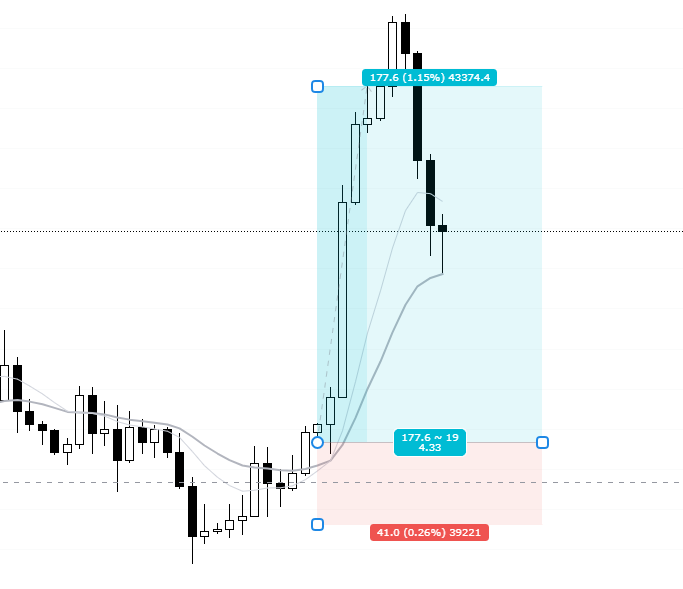

You must let the trade run as long as the market tells you to let it run E.g. you enter a pullback entry, and your exit criteria are that you will exit the market as long as each candle, of that time frame, closes above the 10 ema.

Now imagine that 20 candles later, the price has still not closed below 10ema. Imagine that price is not too far from 10 ema, and they are both going up quite parallel Do you need to exit? is the market telling you to exit? no, it is not.

Now also imagine, if the price goes 100 points away from the entry point within the next 3 candles. Price is too far stretched from the 10ema. Should you follow your 10ema exit plan?

No!!! Absolutely not.

The point is that as you progress and become a more experienced and confident trader, you should focus on listening to the market. Trade what you see. Watch what the market is telling you through the patterns it creates on price.

I hope this makes sense to you.

Have a Great Weekend.