I will show you todays’ trades and its management through the lense of the KC and HUNT 2.0 Signals.

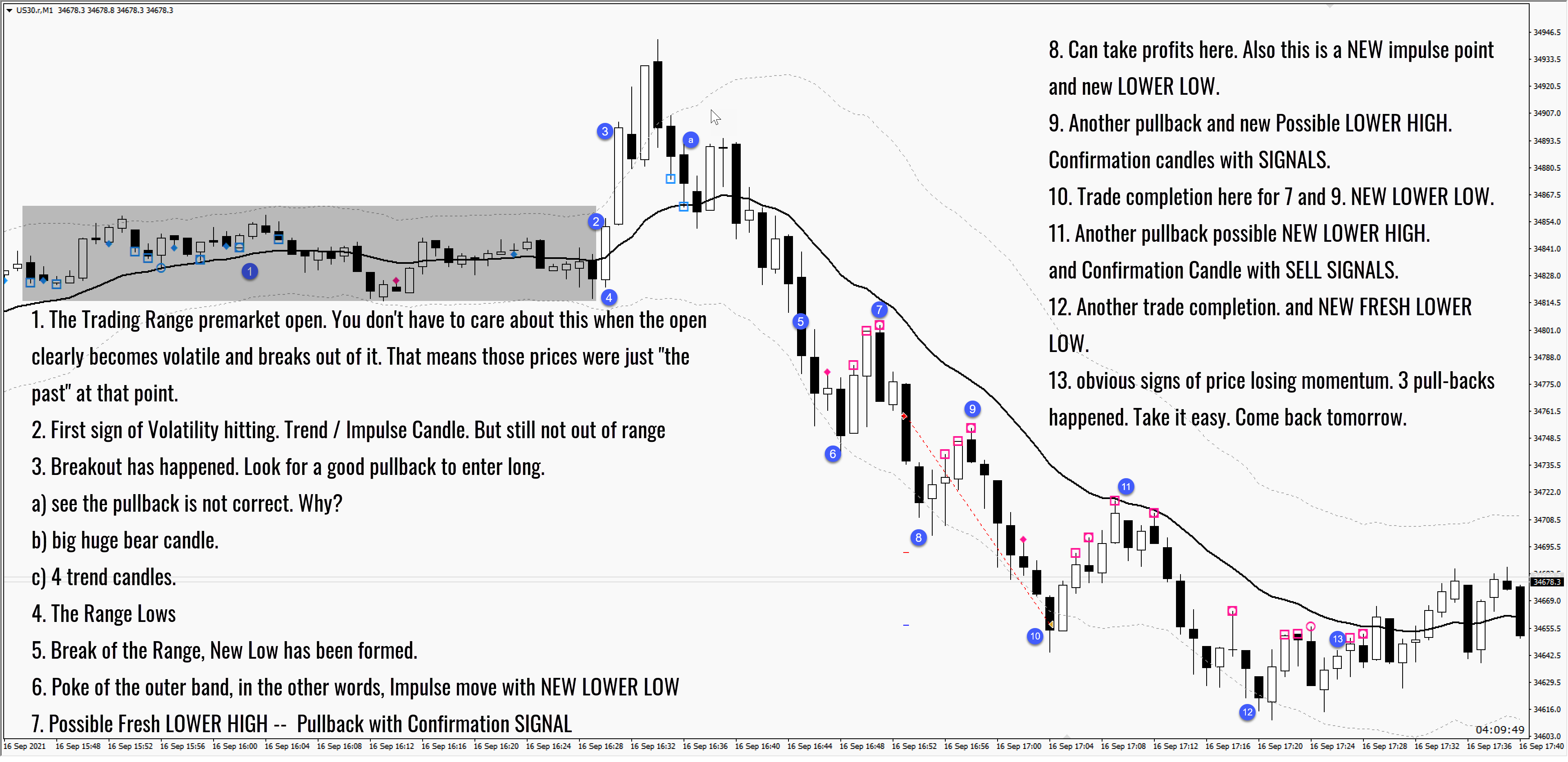

- The Trading Range premarket open. You don’t have to care about this when the open clearly becomes volatile and breaks out of it. That means those prices were just “the past” at that point.

- First sign of Volatility hitting. Trend / Impulse Candle. But still not out of range

- Breakout has happened. Look for a good pullback to enter long.

a) see the pullback is not correct. Why?

b) big huge bear candle.

c) 4 trend candles. - The Range Lows

- Break of the Range, New Low has been formed.

- Poke of the outer band, in the other words, Impulse move with NEW LOWER LOW

- Possible Fresh LOWER HIGH — Pullback with Confirmation SIGNAL

- Can take profits here. Also this is a NEW impulse point and new LOWER LOW.

- Another pullback and new Possible LOWER HIGH. Confirmation candles with SIGNALS.

- Trade completion here for 7 and 9. NEW LOWER LOW.

- Another pullback possible NEW LOWER HIGH.

and Confirmation Candle with SELL SIGNALS. - Another trade completion. and NEW FRESH LOWER LOW.

- obvious signs of price losing momentum. 3 pull-backs happened. Take it easy. Come back tomorrow.