How to Exit

AIMS Entry Alert V5.1 Exit Signals

The entry alert can be used for Exit signals as well. The indicator generates the Black Dot alerts. We use these alerts for two purposes.

- To cancel a pending buy stop or sell stop order.

- To exit out of a trade or close a trade with profit.

Taking Profits with Black Dot Alerts

One of the ways to take profit is to use the black dot. You can use the black dot signal for taking profits as follows:

Close Buy Trades with Profit: The black dot signal is printed above the high of the last candle when the candle closes below the gator green line. Exit or Take Profit and/or Close Trade when the Black Dot appears.

Close Sell Trades with Profit: The black dot is printed below the low of the last candle when the price closes above the gator green line. Exit / Close Trade when the Black Dot appears.

Use Black Dot Only when Trade is in Profit

Notice that we only use black dot for exits when the exit will be a profit. If the trade is not yet in profit the we will let the stop loss be hit.

Profit Taking and Market Conditions

There are 2 kinds of market situations in the market that dictate our exit strategy. The market can be either highly volatile, normal or the volatility might be too low. We generally don’t get into trades when the volatility is low because the system will not generate signals.

Option 1. Normal Moving Markets

A normal moving market is when price trends up and down parallel to Alligator lines. There is no angulation between price and the Alligator lines – see example below.

Option 2. Fast / Runaway Markets

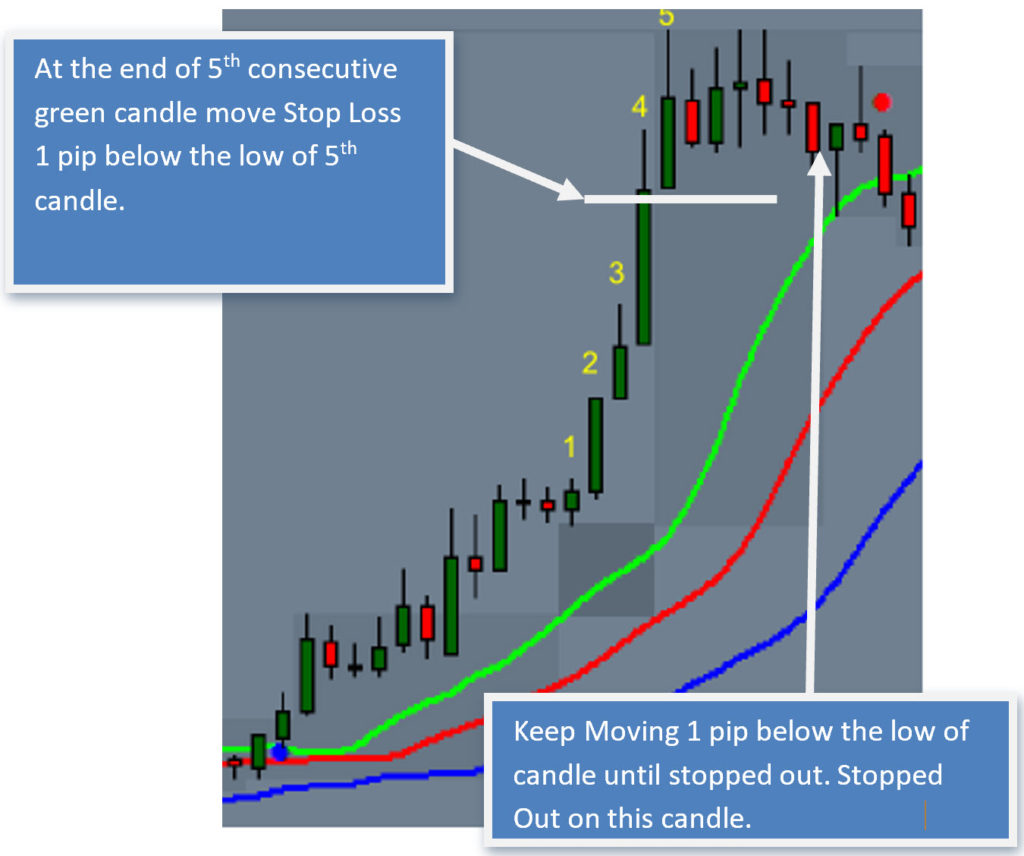

When price runs away from the Alligator’s mouth too fast and gets too far away, creating an angulation between Alligator lines and current price, we trail our stop loss behind the high or low at the close of previous candle, to lock in profit. The concept is that the faster price moves away from Alligator Lines, the faster it may come back to it – the rubber band principle applies.

Rules for Trailing Stop Loss:

- Five consecutive red or green candles that create angulation.

- Occasionally two or three candles may move considerably. In that case, one can start trailing at the end of third candle. E.g. when price moves more than 30pips in two candles, start trailing stops at the end of third candle.

See example below.

Locking Profits with Trailing Stop Losses.

We can also use trailing stop losses to lock in profits. This will depend on whether you want to simply lock in profits because the trade has progressed well in its natural course or because market conditions of changed.

How to Set Trailing Candles Stop Loss?

Trailing stop loss means moving stops incrementally, using a certain criteria. Once trailing candle stop is activated, keep trailing candles by moving stop loss a pip or two below or above the last candle.

For Long Trades: Set Stop Loss 1 (or 1 pip plus spread) pip below the low of the previous candle.

E.g. at the close of the fifth green candle, set stop loss 1 pip below the low of that candle.

Once five candle trailing is triggered, you must keep moving your stop loss below the low of candle that just closed. Continue moving the stop loss until stopped out.

For Short Trades: Set stop Loss 1pip + spread above the high of the previous candle

An Example of Trailing Stop Loss for Buy/Long Trades

An Example of Trailing Stop Loss for Short Trades

An Example of Trailing Stop Loss Exit – A Short Setup

In the picture below,

- We have an open Alligator on M5.

- Price retraces back to the Green Line on M5, creating a lovely Setup 1 on M1.

- We take the Setup short after the Red Dot and break of the AIMS Box at 1.4231.

- Price then moved considerably without a retrace.

- We would have commenced the trailing stop loss – where price retraced a little and resumed.

- I would have either waited for a Dot or started trailing.

- Had I started trailing, my stop would have eventually been hit at point 7.1 at 1.4185, or at 1.4168 at point 8. Waiting for Dot would have got me out at 1.4175 at point 7.3.

- Had I taken the trade just on the M5 chart, it was simple exit on trailing candles, where we have clear consecutive good size red candles – entry at 1.4222 and exit at 1.4172.

More Ways to Take Profits and Manage Trades

We invited to take the T20 Challenge in the next step of this program. If you are up for it, enroll into the course “How to be a Disciplined Trader”. We will give you some more ways to exit and manage your trades.

Know your Exit Strategy before Taking a Trade

Exiting is the most important part of trading. Successful Trading requires cutting losers short and letting winners run. That is not always true but it depends on your strategy. For the purpose of this strategy we are looking for at least 1:2 Loss to Win Ratio trades.

Use Fib Expansion tool to set take profit levels. This method is very powerful and gives you statistical edge

The Difference between Successful Traders and Losing Traders

- Successful Traders know their exit strategy before they enter the market.

- Losers decide their exit strategy soon after they enter the market.

- Successful Traders don’t get scared when price goes against them; they follow their exit plan.

- Losers get scared when they see a few pips in profit; they get scared of giving the pips back and exit prematurely on a small retrace, only to be later regretful when price keeps going in the original direction.

- Successful Traders are relaxed and enjoy the experience; they wait patiently for Entry and Exit signals.

- Losing Traders are stressed, anxious and scared; they do not enjoy the process.

- Successful Traders get out of losing trades quickly; they follow their exit plan.

- Losers get out of their losing trades far too late; they hope and pray for price to turn around; they either don’t have a pre-defined stop loss or fail to follow their plan.

- Successful Traders let the winners run by following their plan.

- Losers cut their winning trades short prematurely; they either do not have an exit plan or fail to follow one.

Points to Remember

- Time entries on the break of the First AIMS Box outside Alligator’s mouth

- The further away price is from the Alligator’s mouth, the more chance of price turning around

- The longer the price bars, the greater the chance of price either stalling or turning around

- The probability of success is higher at the break of 1st and 2nd AIMS Boxes outside the sleeping Alligator’s mouth

- The probability of success is lower at the 3rd or 4th AIMS Boxes outside the Alligator’s mouth

- The probability of success is higher when AIMS Wave Histogram Bars are short and close/near the Zero Line.

- The probability of success is lower when AIMS Wave has peaked and/or diverged.

- The probability of success is higher when the entry-level is near the Alligator Lines

- The probability of success is lower when the price is away from Alligator Lines