Testing Testing Testing. Covid 19 has almost paralyzed the world but we are gradually getting out of its grip. How do we know we are getting better? We TEST. Do you have the covid? GET THE TEST. Have you taken the test? Yes or No? IF yes, is it Positive or Negative?

This is all we have been doing all over the world during the last 12-18 months. In fact, tests are being given, taken, and performed in labs or outside of it all around the world all year round. It’s not just Covid-19 that needs testing. Testing is an integral and critical part of the medical world. We must test to find out if it is TRUE or FALSE.

He’s coughing, having a fever, GET A TEST. She is feeling a bit down, GET A TEST. He might be having high blood pressure? GET A TEST. She might be diabetic, get a test.

Why do we test? And what if you did not test?

A test gives us a simple binary answer. TRUE or FALSE. 0 or 1. As traders, we know this very well. When we trade with our trading indicators or when we code algorithms and scripts to test our strategies, we are looking for one answer to this very question.

Does it work? True or False?

This Sunday I am locked at home because Mr. A has tested positive and we are all locked. We are still unsure since the second line on his test was a bit faint. However, we have since taken A to take a PCR test and awaiting results.

COVID 19 TESTING: I have been testing all of my life. Not the Coronovirus test but all sorts of tests. Testing Testing Testing.

You see, we are forex traders and trading is a numbers game. We are always looking for “Edges” in the market. Trading is a game of probabilities and pattern recognition. If you don’t know what an edge is, then you most probably don’t have one. Not yet.

In the world of financial trading, the most important part of a trader’s job is TESTING. There are several forex backtesting methods available to us. We can do manual testing, automated testing, and semi-automated testing. But testing is what we must do. Can’t do without it!

Forex Stratgy Testing Software:

These days almost all trading platforms have strategy testing options. MT4 Platform has a strategy testing option. You can also do your strategy testing in Tradingview or TradeStation or eSignal. There are also custom softwares available that are designed specifically for Forex Testing. One such software and my favorite are Forex Tester. Get the DEALS Here

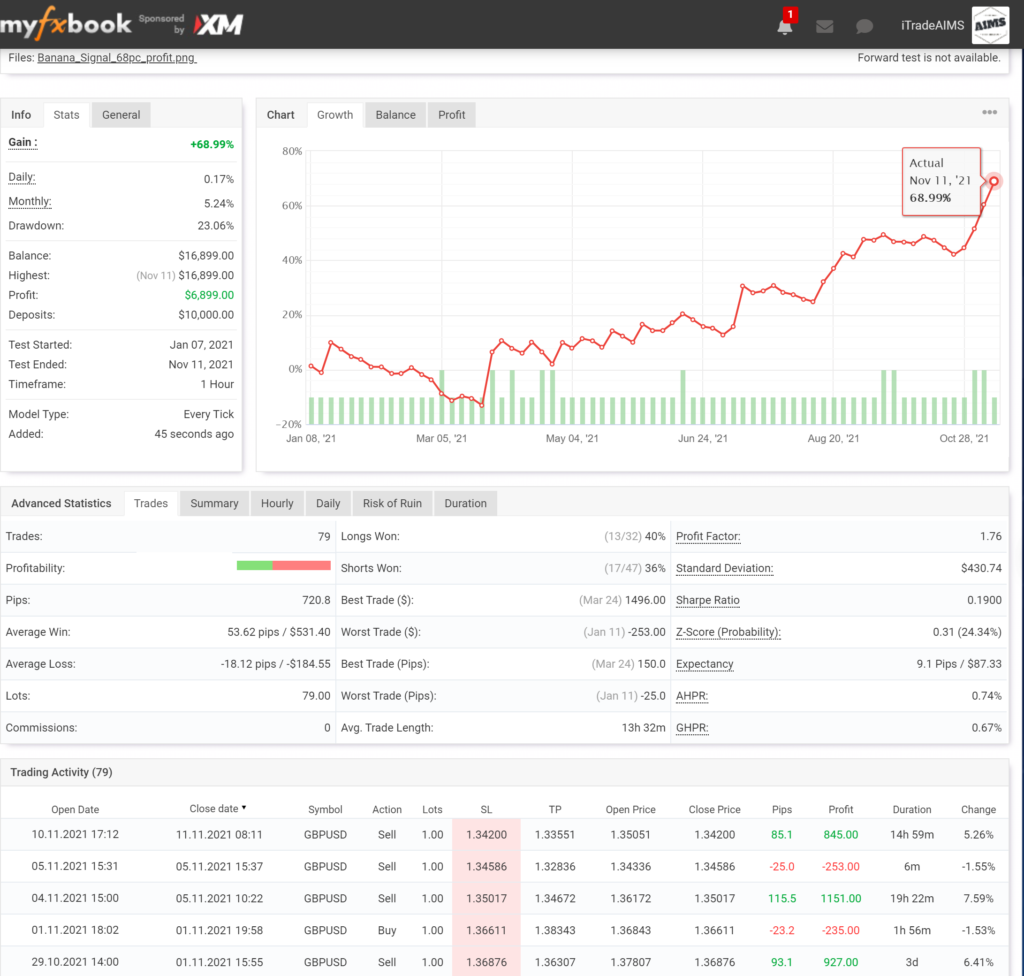

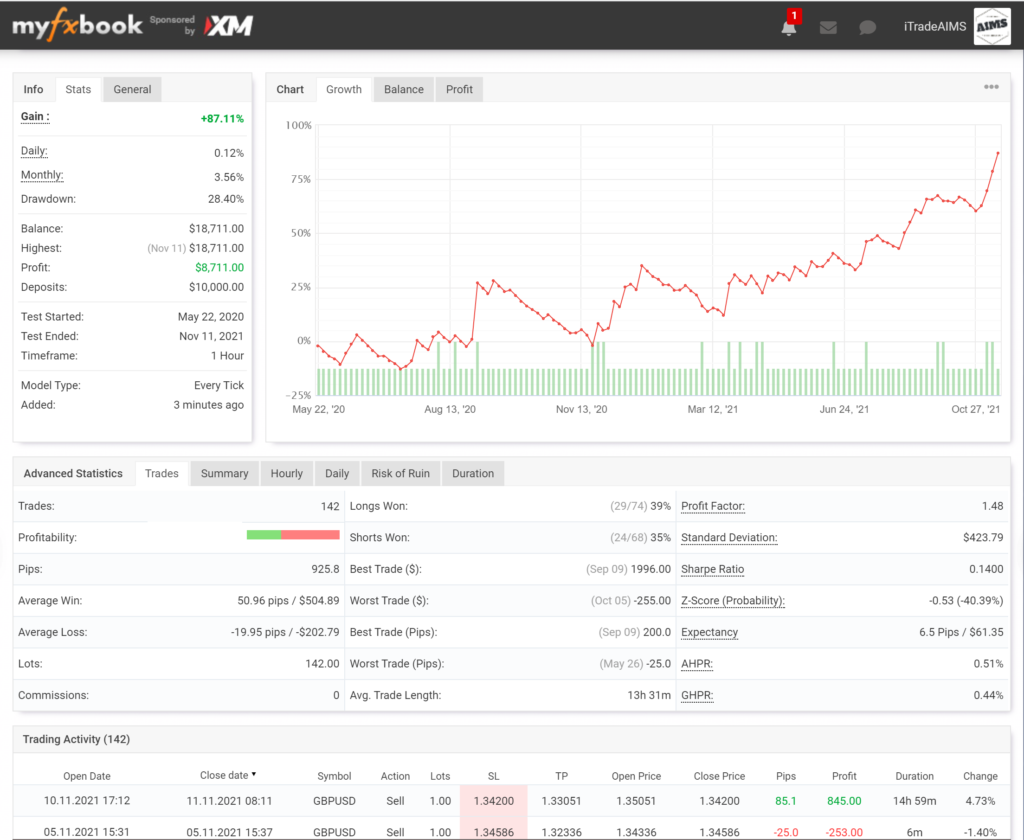

I have been doing a lot of testing this year. However, it intensified over the last few weeks as I was finalizing an expert advisor based on the Banana Concept. I have created my own strategy testing script that we use to test our strategies.

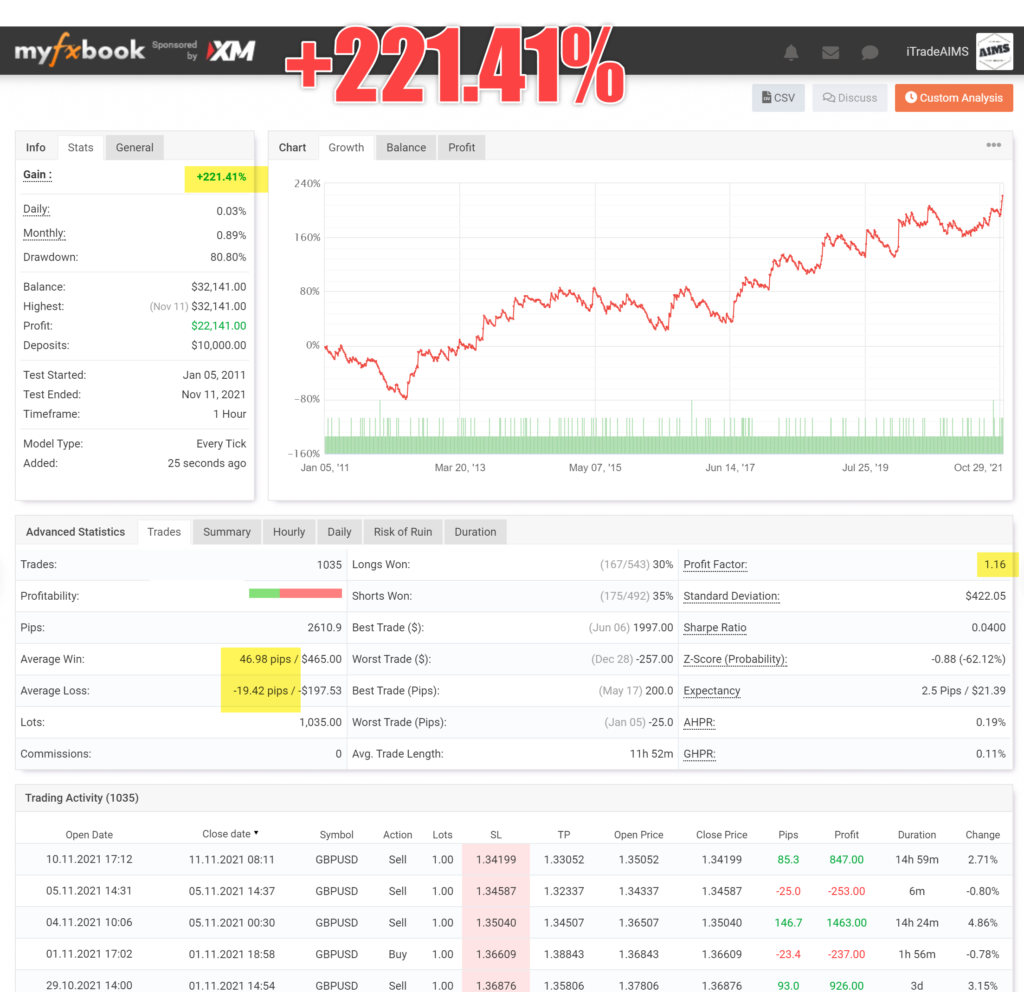

AIMS The Hunt – The Banana Version 8 has proven itself to me and the community properly. It gives us a positive expectancy.

It gives us a profit factor of 1.2 on some markets yet on others a profit fat or 1.6 or more. It works 30% of the time, (a 30% Winrate) on others 50% of the time. But no matter where you go, it gives you some sort of positive result. That is EPIC.

Caution

We do have to keep in mind though that nothing is perfect. It does not always have the edge for all the markets and all the time frames under all the circumstances.

However, we can say with confidence, that for every market and time frame, there are certain tweaks that improve the odds of winning. I wish we could produce a method that worked on all time frames and all markets with the same parameters. But sadly that is not how the market works. Markets behave differently on different time frames. Gold does not move like Cable and #AAPL does not move like #TSLA.

What all of this means is just ONE THING!

My Point is … (Conclusion)

The Banana Indicator or the Pullback Pattern as defined by our rules gives the trader a Solid Trading Edge. A trading strategy with a Positive Expectancy. It is your Trading Edge in the Market.

Trading is the game of probabilities, and edges. And there are edges out there in the market and this is one of them. Edges are usually only small edges and therefore it requires a larger set of data. 10 or 20 trades don’t prove or disprove an edge/setup. That is why we run these tests of 10-20 even 30 years of data. High-quality data is hard to find and expensive. But you have to do the testing, there is no other way. Would you ever build a house without proper planning?

These tests help us understand the market and our methods better. It enhances our understandings and boosts our confidence in our method.

Wish you all the best and hope you’re enjoying your weekend with your loved ones.

Regards

Immy

ps: I later thought that I may have missed pointing out an important aspect of testing. I shared these thoughts in our Discord Server.

The Human Factor:

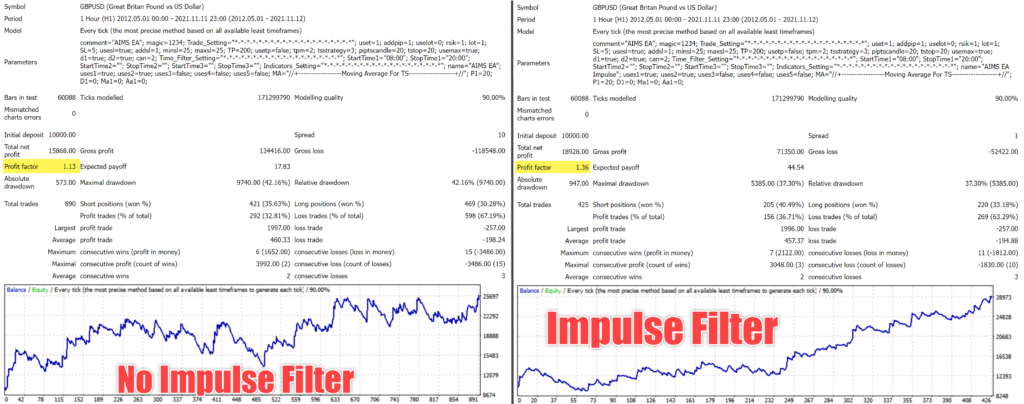

Remember though the Human Factor: No matter how objective and elegant the code, The BOT (the trading expert advisor, script or algorithm) can’t really figure out the 4 Most Important Questions. The first being, Is there an impulse move?

The Banana Indicator comes with a flow chart of 4 Questions. We only take signals that have 4 YES answers to 4 Questions.

It is hard to code some logic. The pullback pattern that gives us the highest probability of winning occurs during trending markets. The pullback method is NOT to be used within tight ranges. The testing bot, (at least the one we are using for now) can’t do certain things such as;

- It can’t figure out “Is there an impulse move?”

- It can’t figure out “Is the move climactic”

- It can’t figure out, “Is the pullback Impulsive?”

- It can’t figure out, “Trend vs Range”; is the entry within the trading range or out of the trading range?

- It can’t figure out, “Filter Tight Ranges”; How to Only take entries within trends?

And this, above, The Human Factor, if you like, makes the System HIGHLY Effective. When the “human eye” or “observation”, assuming the trader exercises at least an 80% discipline, meaning being objective, can eliminate a lot of unnecessary losses. Because we can assess quality. When you do this then the system goes from 35% Win rate to 66% win rate. And that makes it an extraordinary method to trade. Models are simple and robust. We can make them better when we are disciplined and worse when we trade with emotions.