Support and Resistance levels can be useful in trading but not every level becomes a support or a resistance level. In this article we are going to look at why I ignored this particular Support Level? Should you pay attention to these levels or not?

I took a trade on the GBP/USD on the 26th of April. It was a beautiful signal. I took the signal, headed off to the gym and came back to see a fantastic 3R Winner.

It was a Nice $3094.34 winner. Simple trade, just saw the signal, took the trade and let the market do it’s magic.

But…

Members of our discord group wanted to know something. We have 7 Rules of Entry for the Banana Indicator. One of the rules is to pay attention to the levels to the left.

Question: Is this Support Level Not Important?

Hey, Immy, why would you take this trade when there is clearly a ~Level to the Left? You keep saying, don’t take trades when there are levels to the left.. .then what is this? Explain why?

A good question about support and resistance levels. Forex trading, some say, is all about support and resistance. I don’t agree with this statement entirely but it has some truth to it.

- Why did I not pay attention to this level to the left?

- Have I deliberately ignored this support level?

- Or is the matter even worse; Am I being inconsistent in my trading?

Here is why I think this is not the level to the left that you should worry about too much.

Innocent Until Proven Guilty

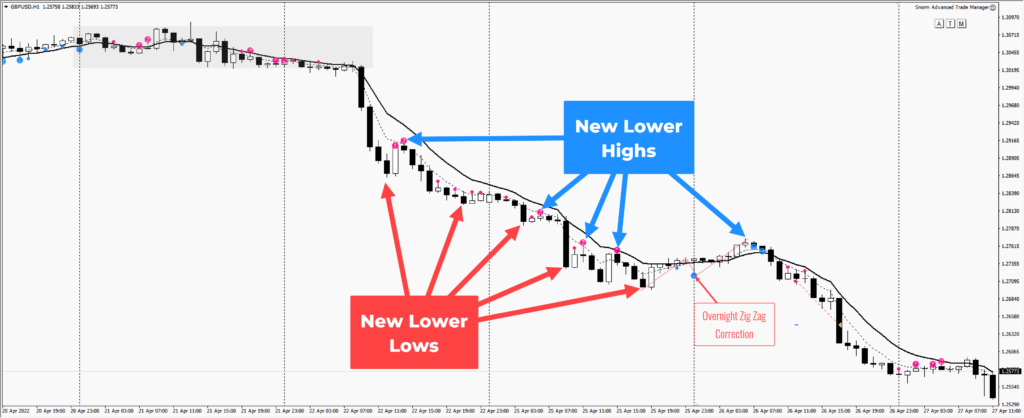

The trader must know how to differentiate between trends and trading ranges. Understanding of the Market Cycle might help.

When the market is in a trading range, the levels to the left are VERY important. When the market is in a trend, the levels to the left are only potential areas where the trend might stall or possibly end. But when you see a swing high or low within a trend, those levels often get broken easily because there can not be a trend without breakouts and creation of new lows or new highs.

A Rule for Support or Resistance Level

I have a simple rule for when I would consider a level as a support or a resistance level.

At least 2 Touches: The Rule is, that price must touch this level at least two time, otherwise it is not a level of concern.

What is a A Trading Range? When you get two equal highs and two equal lows it becomes a trading range.

What is a Trend? When you see a series of new higher highs and higher lows, it is an up trend. When you see a series of new lower lows and lower highs you have a down trend.

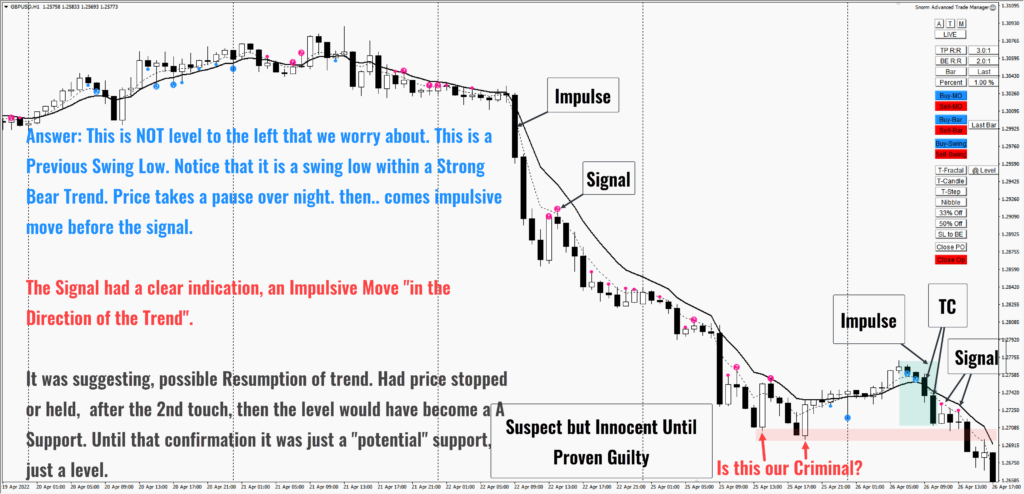

Answer: Why I did not filter this signal?

I did not filter the signal because this ia not a proven support level. This is NOT a level to the left that we worry about. This is a Previous Swing Low. A swing low that has been part of down trend. I was new lower low within a Strong Bear Trend. Price takes a pause overnight, then there comes an impulsive move before the Banana Sell signal is printed. (Take our Stage 2 Course to Learn more about the Banana Method)

The Signal had a clear indication, an Impulsive Move “in the Direction of the Trend”.

It was suggesting, possible Resumption of trend. Had price stopped or held, after the 2nd touch, then the level would have become a A Support. Until that confirmation it was just a “potential” support, just a level.

A good place to learn some basic forex trading technical analysis is a BabyPips.com. They have a school. You will also find great forex trading courses here on this site.