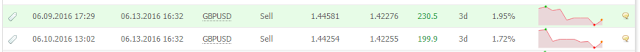

What matters the most here is the Return to Risk Ratio. We risked only 40 pips for the first entry and it was turned into a free trade before we entered the second trade and we only risked 30 pips for the second entry. So total risk of 70 pips (but not at once, only 1% risk at any given point) and a Return of 430 pips. Here is the breakdown:

5.8% profit on first entry

Plus

6.6% profit on second entry

a total Return of 12.4%

Total Holding Period 3 Trading Days

Note: Whenever you look at return percentages, your first question should be “What was the risk”. The beautify of this strategy is that at any given point we were never risking more than 1% of our account. Yet we managed to return 12.4% on it. Thats what I call Asymmetric Risk Return Formula.

Thank you #PTJ, #PC and #TR.

|

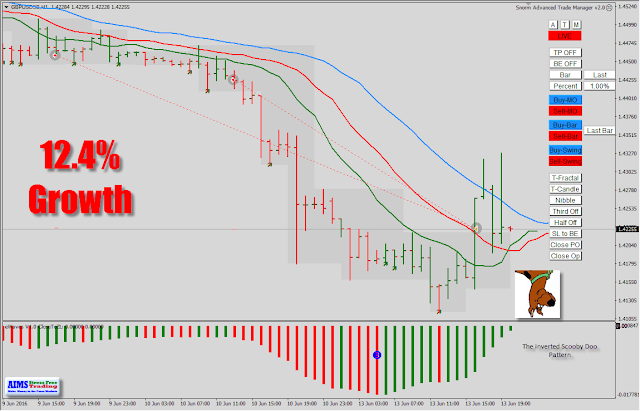

| We can see that profit taking happened on GU but it attracted a lot of limit sell orders an more sellers have joined the party. |